The number of M-Shwari users in Kenya has been increasing daily since its initial launch in 2012, currently reaching 4.66 million users as of 2021, proving how it has rapidly become a game changer in the Kenyan financial market. It’s a savings and loans service that all M-Pesa users can access directly from their mobile phones.

Unlike traditional lenders such as banks, the good thing with M-Shwari is that you don’t need paperwork or even a guarantor to get a loan, proving their accessibility to millions of Kenyans. However, with the number of users increasing, a challenge that most M-Shwari users in Kenya face is the M-Shwari limit being set to zero.

There are many reasons why you may be facing the zero loan limit with M-Shwari, one of which is being a new user of the service, along with others, as covered in the article below. The good news is that if you are in this situation or have a lower-tier limit, you should know that the zero limit is not a permanent problem, as there are solutions to increase your loan limit to the maximum amount quickly.

In this guide, we have covered everything that you need to know about recovering from a zero limit and building your way to the maximum Ksh 50,000 loan capacity.

What Is M-Shwari and How Does It Work?

M-Shwari is a product launched by the Commercial Bank of Africa (CBA), now NCBA Bank, and Safaricom through M-Pesa. It is both a loan and savings account service because NCBA Bank issues savings accounts and loans by assessing risks and non-performing loans (NPLs), while M-Pesa provides its broader reach to millions of users active on the platform.

By the way, it is safe to say that M-Shwari is a bank on its own since it is subject to all the banking regulations in the country. All active accounts created on the M-Pesa platform sit on NCBA’s financial statement and are tracked in a dedicated banking system linked to Safaricom’s data and the bank’s core banking system. This partnership ensures that your financial data is secure and that all transactions comply with Central Bank of Kenya regulations.

M-Shwari Eligibility Requirements

Before you can access M-Shwari services, you must meet specific eligibility criteria:

- You must be at least 18 years old

- You must be a registered Safaricom subscriber with an active M-Pesa account

- You must hold one of the following identification documents: Kenya National ID, Kenyan passport, or Alien ID.

- You must be an active M-Pesa subscriber for at least 6 months before qualifying for loans

- Regular use of other Safaricom services, such as voice calls, data, and M-Pesa transactions

M-Shwari Limits

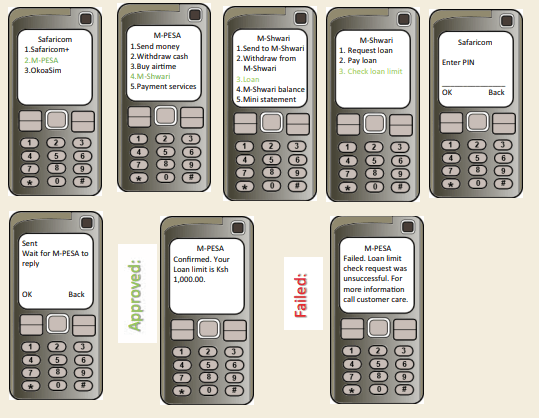

To know your M-Shwari limit, you must be registered on the platform. The joining process is easy and is done via M-Pesa Menu >> My Account >> M-Shwari. Also, you must have deposited at least Ksh 1 to access your limit; the process of checking your account limit is described below:

To easily check Your M-Shwari Limit below is the process to follow:

- Dial *234# or go to the M-Pesa menu on your phone

- Select “Loans and Savings”

- Choose “M-Shwari”

- Select “Check Loan Limit and Fees”

- You’ll receive an instant SMS with your current limit

As of 2025, the minimum M-Shwari limit is KSh 100, while the maximum is KSh 50,000. Here is the catch: this is only available to qualified people—for some, you may be surprised to see your limit at zero (0). There are quite a reasons why this might happen to you. The primary reason is that you are new to using M-Pesa, and your M-Shwari account is also new.

Another common reason is that you have a poor credit score listing. This should not be ignored since M-Shwari checks if a borrower is listed on various Credit Reference Bureaus (CRBs) before you are assigned a loan amount. To ensure you qualify for a loan from M-Shwari, you must demonstrate creditworthiness through deposit behavior, transact on M-Pesa for at least six months, and have no outstanding loans with other lenders.

Why Your M-Shwari Limit Might Be Zero

The main reasons include:

1. If you’ve just joined M-Shwari or haven’t been using M-Pesa services for long enough, the system hasn’t had sufficient time to assess your financial behavior patterns.

2. Being listed on CRB due to loan defaults with other financial institutions automatically disqualifies you from M-Shwari loans until the listing is cleared.

3. Insufficient M-Pesa Activity M-Shwari evaluates your overall M-Pesa usage, including money transfers, bill payments, airtime purchases, and merchant payments. Low activity signals to the system that you may not be a reliable borrower.

4. If you’ve previously defaulted on M-Shwari loans or have a pattern of late payments, your limit may be reduced to zero as a risk management measure.

5. Irregular Savings Patterns. Inconsistent or minimal savings activity on your M-Shwari account suggests poor financial discipline, which affects your loan eligibility.

How to Increase Your Zero M-Shwari Limit

Before we discuss how to get a higher loan limit, you should know that the M-Shwari loan limit review cycle lasts 30 to 90 days. This means that M-Shwari will periodically review your account during these periods to determine your next limit. Below are the proven steps to increase your limit for those with a lower loan amount or even zero.

1. Save with M-Shwari Consistently

By now, it is clear that M-Shwari is both a loan service and a savings account. The minimum amount needed to open an M-Shwari savings account is Ksh 500, and you can save any amount from 1 to 6 months. Your savings earn an interest rate of up to 6% per annum for locked savings accounts.

The key to building your limit through savings is consistency rather than large amounts. Even saving Ksh 100 weekly demonstrates better financial discipline than saving Ksh 1,000 once a month. The algorithm tracks your saving frequency and regularity, using this data to assess your financial reliability.

2. Keep Using M-Pesa Constantly

M-Shwari is built on top of M-Pesa, which means for every active account, the service also has access to your data on M-Pesa, which it uses to determine your loan limit. So, don’t focus only on what M-Shwari offers to get a high loan limit; also, try to use other M-Pesa services such as Lipa Na M-Pesa, buy airtime, send money to family and friends, pay bills, and make merchant payments.

The more diverse your M-Pesa usage, the more positive signals there are for the possibility of a higher limit. The system analyzes transaction patterns, frequency, and amounts to build a comprehensive financial profile.

3. Make Early M-Shwari Repayments

For every loan you are given on M-Shwari, you must commit to paying the loan back, hence avoiding the risk of being listed on CRB, which will also impact your credit score negatively. Generally, the M-Shwari loan is to be repaid within 30 days from the day you borrow, but early repayments are permitted and highly encouraged.

Here’s what happens if you don’t repay on time: If the loan is not repaid by day 31, it is automatically renewed for an additional month. You will receive a text informing you that a 7.5 percent facilitation fee has been charged (on the outstanding balance), and the loan is now due on day 60.

If you do not repay the loan by day 62, any amount in your M-Shwari account will be taken to repay the loan. If you do not have the expected amount on day 90, you will receive a final reminder, and 30 days after this (120 days in total), your details will be forwarded to CRB.

If you pay the loan in less than 30 days, your loan limit qualification will increase. To avoid all complications, pay your loan on time, and furthermore, if you make early repayments, this signifies good financial behavior and increases the chances of an even higher loan limit.

4. Keep Borrowing Responsibly

Even after making repayments of previous loans, continue requesting additional loans when needed. For every loan requested and successfully repaid, both M-Pesa and NCBA Bank record your financial data, and over time, this data will be used to calculate your future loan limits.

However, the key is responsible borrowing—only borrow what you can comfortably repay and avoid borrowing for unnecessary expenses. The system tracks your borrowing patterns and repayment consistency, rewarding users who demonstrate responsible credit behavior.

5. Avoid Defaulting with Any Lender

One of the key mechanisms that M-Shwari uses to calculate if you are eligible for a loan is by checking your records on Credit Reference Bureaus (CRB). In Kenya, there are many loan apps that offer loans—some check with CRB and some don’t. Therefore, before you use M-Shwari, ensure that you have not been listed by any lender and, simultaneously, that your credit score is clean.

If you discover you’re listed on CRB, you must clear all outstanding debts and request a clearance certificate from the respective CRB (Metropol, Creditinfo, or Transunion). This process can take 30-60 days after debt clearance, so patience is required.

6. Maintain Active Safaricom Services Usage

Since M-Shwari is a joint product between Safaricom and NCBA Bank, your overall relationship with Safaricom matters, regular use of voice calls, SMS, and data services demonstrates that you’re a valuable customer who is likely to maintain long-term engagement with the platform.

7. Leverage the Lock Savings Account

M-Shwari offers a special lock savings account that earns higher interest rates (3-6% per annum) than the regular savings account. Using this feature demonstrates your commitment to long-term financial planning and can positively impact your loan limit assessment.

Frequently Asked Questions (FAQs)

What is the maximum amount I can save in M-Shwari?

With the standard savings account, you can save up to Ksh 100,000. This only applies to those using Know Your Customer (KYC) verification. However, the limit can grow to Ksh 250,000 if your national ID is verified and up to Ksh 500,000 if you physically submit your ID at any Safaricom shop.

How long does it take for my limit to increase from zero?

If you are new to M-Pesa and do not meet its eligibility requirements, your limit will likely remain zero until you demonstrate consistent financial behavior for at least 3-6 months. For continuing users, your limit will be reset to zero if you fail to repay your loan after 120 days.

Increasing and growing your M-Shwari limit from zero to KSh 50,000 is entirely possible with the right approach and patience. The key is demonstrating responsible financial behavior consistently over time rather than expecting immediate results.